- Retain credit on the customer account for use when paying another invoice.

- Issue a refund by check or credit card, and

- Apply the credit to an outstanding invoice on the customer account.

The customer requests a credit and rebill of a previous invoice.

This is an example of 3-Apply the credit to an outstanding invoice, and also how to create the new invoice (rebill)

- Using the disputed invoice as a 'model,' choose 'Refund/Credit' from the ribbon menu to create a credit for the current period and apply it to the disputed invoice.

- To issue the rebill, choose 'Create a copy' using the disputed invoice from the ribbon menu. This will assign a new invoice number and a new date. The original invoice date can be used if the rebilled invoice is from the same period. The latest period date is used if the disputed invoice is from a prior period. Make the requested corrections and save the invoice.

This will ensure the credit memo and the reissue invoice are recorded in the same period.

The new credit memo will be applied to the disputed invoice, reducing the amount due on the customer account.

Retain a credit on the customer account.

When a customer returns a product for which they have already been invoiced and paid, use the original paid invoice as a model. Choose 'Refund/Credit' from the ribbon menu to create and save a new credit memo for the customer to use in future payments.

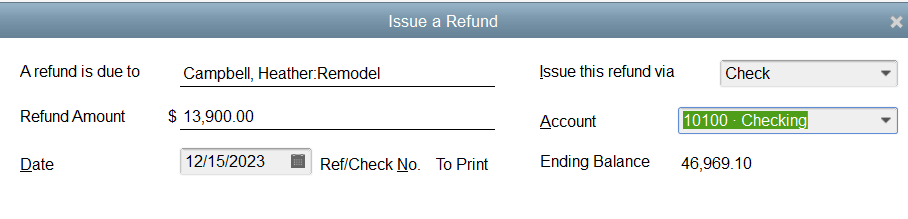

Issue a refund by check or credit card.

. Access the paid original invoice and create the credit memo. Since the invoice has been previously paid, choose 'use credit to give a refund'.

In the Account section of the refund, choose the checking or credit card account to issue the payment.

Utilizing credit memos for customer credit processing ensures the original transaction is properly reversed to the accounts receivable, inventory, income, and cost of goods general ledger accounts.

Workarounds don't work.

Some organizations want to circumvent the accounts receivable refund process by setting the customer up as a vendor and issuing a refund check through the check-writing option. Reimbursing a customer by writing a vendor check does not reduce the income incurred through the original invoice. This procedure leaves income overstated by the amount of the refund. If the customer's refund check does not use the item tab, the inventory will not reflect the return of the product.

In addition, organizations processing customer payments by credit card often misunderstand the flow of credit card receipts to the operating account. Customer credit card payments flow directly to the operating account for many organizations. When the customer's credit card payments are part of the operating account, the customer refund can be issued as if it were a check. This will be reflected in the credit card processing software maintained outside of QuickBooks. For example, a customer refund is issued to the credit card using the bank's credit card processing software. The customer refund must also be entered using the QuickBooks customer credit processing to ensure that cash and the customer account are correctly recorded. Issuing the customer credit in the credit card processing software only causes money and income to be overstated.

Circumventing the established QuickBooks process for handling customer refunds can cause cash to be overstated, income to be overstated, cost of goods to be underestimated, and inventory to be understated if the goods are returned. This also puts additional strain on the bank reconciliation process by increasing the time needed to reconcile the exceptions in the credit card processing and creating the journal entries required to reset the affected general ledger accounts, circumventing the process.

No comments:

Post a Comment